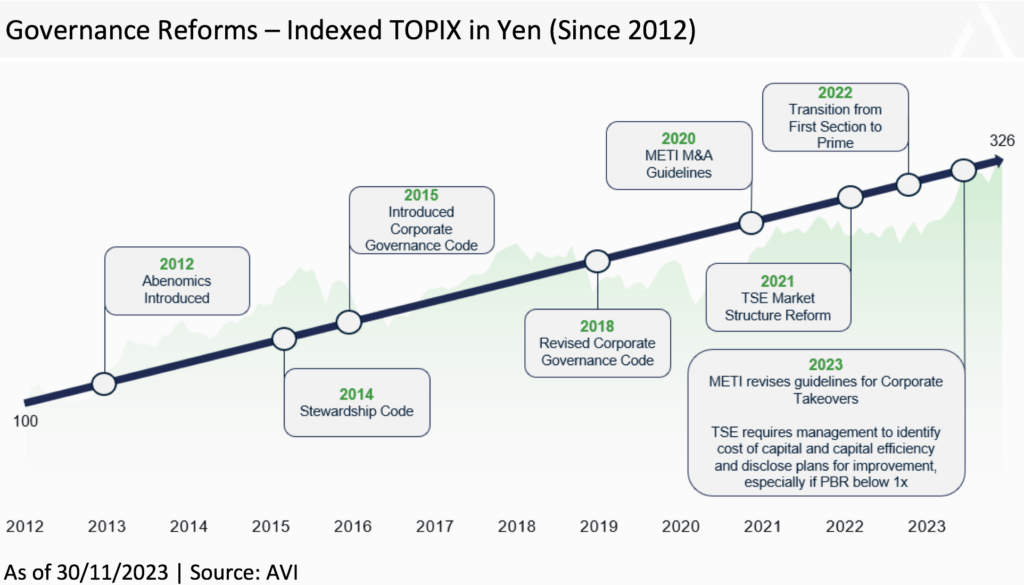

It all started in 2012 with Shinzo Abe’s economic legacy, coined Abenomics. The first two arrows – monetary policy and increased government spending, were quick to implement while early signs of the third – economic structural reform – were starting to emerge. At AVI, it seemed the right time to seize the opportunity in Japan.

By the beginning of 2019 it was evident that the Corporate Governance Code was having a marked impact on the behaviour of companies and shareholders in Japan. Attitudes towards balance sheet efficiency, operating efficiency and shareholder returns were shifting. We began to see an increase in the quantum and success of shareholder activism. During the 2019 AGM season, a record 54 companies received shareholder proposals, 28% more than the previous year.

Private Equity joins the Party

This new shareholder activism in Japan came to the attention of private equity funds and by the end of 2019 large global private equity players were showing their enthusiasm for Japan. For some time, they had been aware of Japan’s abundance of excess balance sheet cash, potential for margin improvement, and cheap financing; however, the changing corporate governance environment was prompting renewed interest. KKR, Apollo, Blackstone, Bain, Carlyle and Permira had offices or were quickly opening offices in Japan.

This trend was encouraging especially as the type of companies AJOT held were ripe for acquisition. Companies with no debt, copious excess cash and consistent free cash flow generation. AJOT benefitted from its first takeover transaction when Nitto FC was taken private at a +38% premium by a private equity firm.

The Unexpected: COVID-19

The outbreak of COVID-19 and the related lockdowns led to a broad sell-off in global assets. There were few safe havens, and although Japan experienced a lower infection rate than Western countries, Japanese equities suffered, nonetheless. The severe economic shock from an unforeseen event like COVID-19 highlights the advantages of investing in resilient companies with solid balance sheets. While in the short-term factors might weigh on performance, we were confident that our companies were well positioned for a recovery.

The second quarter of 2020 saw a strong recovery in equity markets, as fears of a prolonged shutdown from the COVID-19 outbreak receded. However, 2020 was not an easy year for our strategy as it stifled our engagement activity and portfolio companies took a more cautious stance on reform. We proceeded, despite restrictions on travel, with our public campaign on Fujitec, a global manufacturer of elevators and escalators. We launched a website highlighting a multitude of issues ranging from low margins, poor shareholder returns to manufacturing inefficiencies.

Governmental and Regulatory Bodies on Side

Throughout this period the message from the governmental and regulatory bodies was clear – they will keep ratcheting up guidelines and regulation to ensure reform continues. The Financial Service Agency, METI (Ministry of Economy, Trade and Industry) and the TSE (Tokyo Stock Exchange) were seemingly aligned on supporting corporate reform and shareholder engagement. This pressure from

the government and regulatory bodies continued when the TSE announced that shares held by domestic banks and insurance companies would be excluded from its free float calculation. This was a direct attack on Japan’s allegiant shareholder problem and created more opportunity to engage with some of our portfolio companies on unwinding cross-shareholdings.

In 2020 PM Shinzo Abe resigned due to ill health, but his successors, Yoshihide Suga then Fumio Kishida in 2021, continued Abe’s reform agenda. The corporate reform arrow had already been launched and changes in politicians would not deter it.

By 2021 an updated Corporate Governance Code was released. The most salient points were the ones focused on independent directors with pertinent skills and the requirement for listed subsidiaries to oversee conflicts of interest. This scrutiny on listed subsidiaries was positive for AJOT as we had exposure to six listed subsidiaries at that time.

In 2023, the TSE followed through on their announcement calling on companies to address low valuations. This was mostly aimed at the 1,800 companies in Japan that trade on a price-to-book ratio of less than 1x. It was an encouraging step, highlighting that regulators are continuing to use their powers to promote reform. Then later in the year METI published its “Guidelines for Corporate Takeover”. The guidelines contained encouraging wording and we made our first tender offer to a portfolio company, seeking to take a minority stake. The option of putting forward tender offers won’t be an appropriate strategy for all our holdings, but we believe the environment has evolved in such a way that unsolicited tenders can now become a valuable tool to add to our engagement repertoire.

Engagement Campaigns

Looking back over the past five years, we launched 10 public campaigns and numerous more private engagement campaigns. We submitted 14 shareholder proposals, created 10 campaign webpages, wrote over 100 letters to managements and Boards and held nearly 500 meetings. The responses have for the most part been accepting, and increasingly so with companies becoming more aware of their responsibilities to shareholders.

| Engagement Type | Five Year Engagement1 | # Portfolio Companies |

| Presentations | 44 | 18 |

| Letters | 105 | 29 |

| Press releases | 10 | 7 |

| Meetings | 493 | 41 |

The Carrot or the Stick

Although most of our engagement was private, our public campaigns helped to add pressure to both the companies being targeted and our other portfolio companies. Overall, our public campaigns – which some might perceive as aggressive in their demands – have enabled us to deepen the relationship with our portfolio companies. We believe by focusing on a whole suite of issues, not just capital efficiency, and basing our arguments on the principles of the Corporate Governance Code, it has been harder for management to push back against our suggestions. The intent of our campaigns was to raise awareness of issues weighing on the share price, force management to discuss them, and encourage other shareholders to pressure management to rectify them.

The Macro Environment

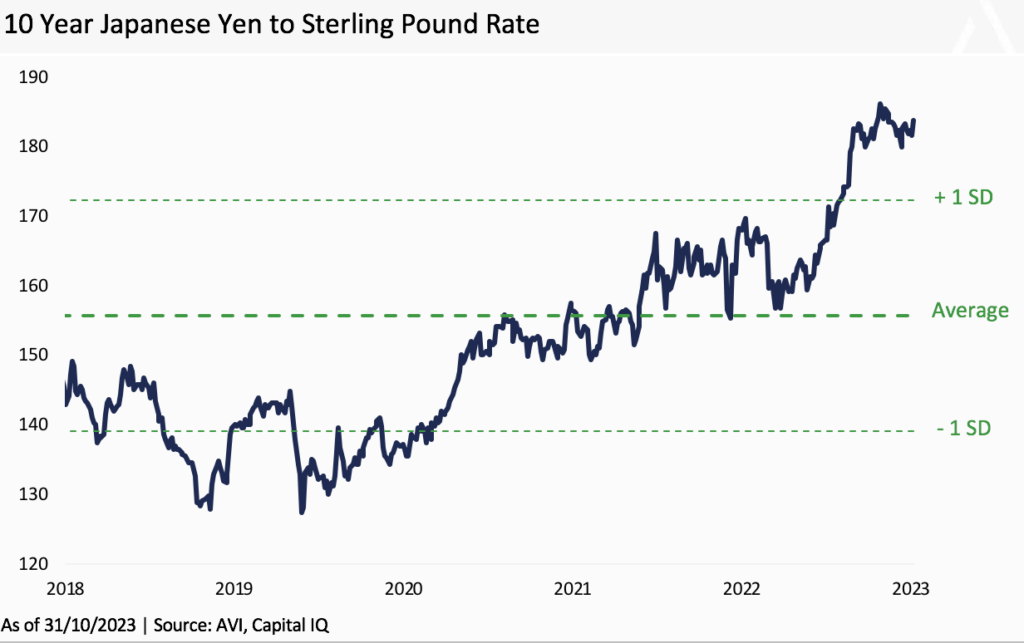

We are optimistic about the macro environment in Japan. The weak Yen makes Japan highly cost-competitive, both for tourism and manufacturing. Inflation has continued to creep higher having returned after a 30-year absence and with wage growth and increased spending, we see a more rational allocation of capital and improved productivity. This bodes well for the companies we invest in. The Bank of Japan (BOJ) expansionary monetary policy over the past five years has weighed heavily on the Yen, which on an effective real exchange rate basis is at the cheapest since the early 70s. Even a small adjustment in monetary policy could lead to a stronger Yen. This could be a driver for attractive absolute returns.

Case Study: Challenges

SK Kaken, a manufacturer of construction coating paints, has been in the portfolio since inception, generating a return on investment of -23% with an IRR of -6%. Our proactive engagement with SK Kaken management has broadly focused on capital allocation and liquidity enhancement, corporate governance, and shareholder communications. AVI has consecutively submitted shareholder proposals at the three most recent AGMs. At the latest AGM, we sought to return the excess cash being hoarded on the balance sheet back to shareholders via dividends as well as the cancellation of treasury shares. We achieved majority support from minority shareholders; however, the resolutions were not passed due to the founding families significant ownership stake.

More positively, despite the founding Fujii Family holding more than 40% of the votes, management recently completed a 5-for-1 stock split, have reduced director tenure, transitioned to a company with an audit & supervisory committee, increased board independence, and improved disclosure of ESG performance and quarterly results. Although we are pleased that management have implemented some of our suggestions, there is a long way to go with SK Kaken still trading on a derisory EV/EBIT multiple of 0.3x, compared to its peer group average of 8.4x.

Case Study: Successes

Fujitec, an elevator installation and maintenance company, was a near five year holding since inception in October 2018, generating a return on investment of +111% and an IRR of +32%. We engaged extensively with Fujitec management on several areas, including operational improvements, capital allocation, corporate governance, and shareholder communications.

In early 2020, having been a shareholder for more than a year and having received a lacklustre response from management to the three letters we had sent thus far, our engagement turned public as we launched the AVI campaign website ‘Taking Fujitec to the next level’. This prompted a more pragmatic response from management, as Fujitec announced its future strategic direction plan and later revised its Vision24 min-term plan after AVI threatened another public presentation and accompanying press release.

Overall, despite early resistance, management responded positively to our suggestions, announcing a share buyback program, reorganising the board to be majority independent, and providing full English translation of results. As a result, Fujitec’s EV/EBIT valuation multiple increased from 6x to 20x over our investment period.

Summary

A famous Japanese proverb is an apt one, “fall seven times and stand up eight”. We can write numerous letters and presentations to management and boards of companies before receiving a positive response, but perseverance pays off. The environment has become more supportive for our approach, and we remain convinced that our strategy is effective. The opportunity in our portfolio to outperform is impressive and we see the developments over the past five years as a strong tailwind to propel us forward.

This article was written by AVI Japan Opportunity Trust (AJOT)

Header image courtesy Kaichieh Chan via Pexels.com